Understanding Forex Trading: Definition and Insights

Forex trading, short for foreign exchange trading, refers to the process of buying and selling currencies in the foreign exchange market. It is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. This activity plays a crucial role in the global economy, facilitating international trade and investment. In this article, we will explore the intricacies of Forex trading, including its definition, how it works, the benefits it offers, and tips for new traders. To begin your journey in this field, consider checking out the forex trading definition Best Platforms for Trading.

What is Forex Trading?

At its core, Forex trading involves exchanging one currency for another. For instance, if you think the value of the euro will rise against the US dollar, you would buy euros and sell dollars. Conversely, if you anticipate that the euro will decline, you would sell euros and buy dollars. This trading occurs on the Forex market, which is open 24 hours a day during weekdays, allowing traders to respond to market movements and news at any time.

The Mechanism of Forex Trading

The Forex market operates through a network of banks, financial institutions, and individual traders who exchange currencies. Unlike stock markets, Forex does not have a physical location; it is a decentralized market facilitated by electronic platforms. The primary participants in this market include central banks, commercial banks, brokers, and individual traders.

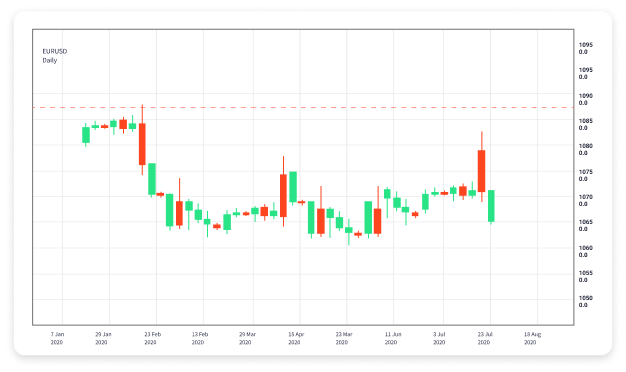

Currency trading is done in pairs, such as EUR/USD or USD/JPY, where the first currency is the base currency, and the second one is the counter currency. The exchange rate indicates how much of the counter currency is needed to purchase one unit of the base currency. Traders aim to profit from fluctuations in these exchange rates by utilizing various trading strategies and analysis methods.

Types of Forex Trading

There are several types of Forex trading, catering to different trading styles and objectives. The main types include:

- Day Trading: This involves buying and selling currencies within the same trading day to capitalize on short-term price movements.

- Swing Trading: Swing traders hold positions for several days to capture price trends and swings in the market.

- Scalping: This ultra-short-term trading strategy focuses on making small profits from minor price changes, often executing dozens of trades in a single day.

- Position Trading: Position traders hold trades for weeks, months, or even years, focusing on long-term trends and fundamentals.

The Benefits of Forex Trading

Forex trading offers several advantages that attract millions of traders worldwide:

- Liquidity: The immense volume of trading ensures high liquidity, allowing traders to enter and exit positions with minimal price disturbance.

- Accessibility: With the rise of online trading platforms, anyone with an internet connection can participate in Forex trading, making it accessible to all.

- Variety of Pairs: Traders have the option to trade a wide range of currency pairs, providing numerous opportunities for profit.

- Leverage: Forex brokers often offer leverage, enabling traders to control larger positions with a smaller amount of capital. However, this also increases risk.

- Round-the-Clock Market: The 24/5 nature of the market allows traders to manage their positions and react to news events at any time.

The Risks Associated with Forex Trading

While Forex trading presents myriad opportunities, it is also fraught with risks. These include:

- Market Volatility: Forex markets can be highly volatile, leading to sudden and significant price fluctuations that can result in losses.

- Leverage Risk: While leverage can amplify profits, it can also magnify losses, sometimes leading to the loss of an entire trading account.

- Counterparty Risk: Since Forex is an over-the-counter market, there is a risk that the counterparty may default on a trade.

- Regulatory Risks: Different countries have varying regulations regarding Forex trading, and changes in regulations can impact traders.

Forex Trading Strategies

Successful Forex trading requires the development of effective strategies. Here are a few popular strategies that traders often utilize:

- Technical Analysis: Many traders rely on charts and technical indicators to analyze price movements and forecast future trends.

- Fundamental Analysis: This strategy involves evaluating economic indicators and news events that affect currency values, such as interest rates, inflation, and employment figures.

- Sentiment Analysis: Traders using this approach gauge market sentiment to predict price movements based on traders’ emotions and behavior.

Choosing a Forex Broker

Selecting the right Forex broker is crucial for a successful trading experience. When choosing a broker, consider the following criteria:

- Regulation: Ensure the broker is regulated by a reputable authority to protect your funds.

- Trading Platform: Look for a user-friendly and reliable trading platform that suits your trading style.

- Spreads and Fees: Compare spreads and commissions to ensure you are not overpaying for trades.

- Customer Support: Good customer service can help you navigate issues promptly.

Conclusion

In conclusion, Forex trading is a dynamic and multifaceted market that offers traders opportunities to profit from currency fluctuations. However, it also comes with inherent risks that require careful management. Understanding the definition, mechanics, benefits, and challenges of Forex trading is crucial for anyone looking to enter this vibrant market. By developing a sound trading strategy and selecting a trustworthy broker, traders can enhance their chances of success in Forex trading.